- What Are Meme Coins And Why Are They So Popular?

- How To Buy Bitcoin: A Comprehensive Guide For Beginners And Beyond

- What Is Bitcoin? A Comprehensive Guide To The World’s First Cryptocurrency

- How To Store Bitcoin Securely: A Comprehensive Guide

- Bitcoin Mining: A Comprehensive Guide

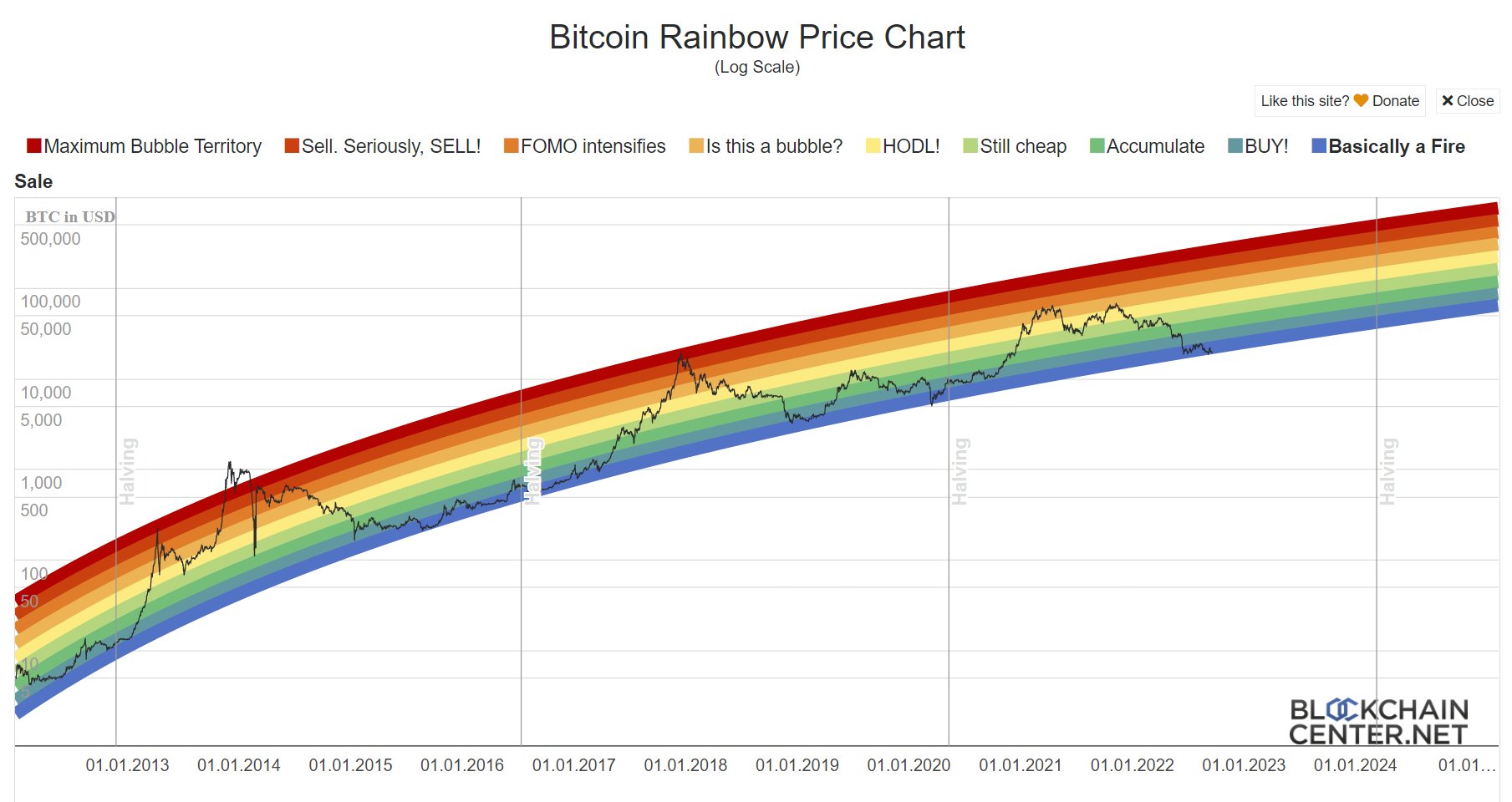

Bitcoin, the pioneering cryptocurrency that sparked the digital asset revolution, continues to captivate investors, technologists, and financial analysts alike. Its volatile price swings have become legendary, creating both fortunes and anxieties in the crypto market. As we approach 2025, the question on everyone’s mind is: where will Bitcoin’s price be? Predicting the future is never an exact science, but by examining key factors and expert opinions, we can paint a plausible picture of Bitcoin’s potential trajectory.

Understanding Bitcoin’s Price Drivers

Before diving into specific price predictions, it’s crucial to understand the forces that drive Bitcoin’s value:

- Supply and Demand: Bitcoin’s scarcity is a fundamental aspect of its design. With a fixed supply of 21 million coins, its value is heavily influenced by demand. Increased adoption and investment drive the price up, while decreased interest can lead to price declines.

- Market Sentiment: The crypto market is highly susceptible to sentiment. News, social media trends, and regulatory announcements can trigger rapid price swings. Fear of missing out (FOMO) and panic selling are common phenomena.

- Institutional Adoption: The entry of institutional investors, such as hedge funds, corporations, and pension funds, has a significant impact. Their large-scale investments can inject substantial capital into the market, lending legitimacy and stability to Bitcoin.

- Regulatory Landscape: Government regulations play a critical role. Clear and supportive regulations can foster growth and adoption, while restrictive measures can stifle the market.

- Technological Developments: Innovations within the Bitcoin ecosystem, such as the Lightning Network for faster transactions, can enhance its usability and value.

- Macroeconomic Factors: Economic conditions, such as inflation, interest rates, and geopolitical events, can influence Bitcoin’s appeal as an alternative asset.

Expert Opinions and Price Targets

Predicting Bitcoin’s price in 2025 is a complex task, and opinions vary widely among experts. Here’s a glimpse of some perspectives:

- Bullish Scenarios: Some analysts foresee Bitcoin reaching astronomical heights by 2025. They cite increasing institutional adoption, growing awareness, and Bitcoin’s potential as a hedge against inflation as primary drivers. Some models predict Bitcoin reaching $100,000, $200,000, or even higher.

- Moderate Growth: Other experts take a more conservative approach, anticipating steady but less dramatic growth. They believe that Bitcoin will continue to gain acceptance and value but will face challenges such as regulatory hurdles and competition from other cryptocurrencies. Price targets in this scenario range from $50,000 to $100,000.

- Bearish Outlooks: Some analysts warn of potential corrections or setbacks. They point to the risk of regulatory crackdowns, technological vulnerabilities, or a shift in investor sentiment as potential downside risks. Bearish scenarios could see Bitcoin’s price stagnating or even declining.

Factors Favoring Bitcoin’s Growth

Several factors suggest that Bitcoin has the potential to experience significant growth by 2025:

- Increasing Institutional Adoption: Major corporations like MicroStrategy and Tesla have invested heavily in Bitcoin, signaling a growing acceptance among institutional investors. As more institutions allocate capital to Bitcoin, its price could rise significantly.

- Growing Awareness and Adoption: Bitcoin is becoming increasingly mainstream, with more people understanding its potential as a store of value and a medium of exchange. As awareness grows, adoption is likely to increase, driving demand and price.

- Bitcoin as a Hedge Against Inflation: With inflation on the rise in many countries, Bitcoin is increasingly seen as a hedge against the devaluation of fiat currencies. Its limited supply makes it an attractive alternative for investors seeking to preserve their wealth.

- Technological Advancements: Ongoing developments in the Bitcoin ecosystem, such as the Lightning Network, are improving its scalability and usability. These advancements could make Bitcoin more attractive for everyday transactions.

Potential Challenges and Risks

Despite the optimistic outlook, Bitcoin faces several challenges and risks that could impact its price in 2025:

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and governments around the world are grappling with how to regulate Bitcoin. Unfavorable regulations could stifle adoption and negatively impact its price.

- Competition from Other Cryptocurrencies: Bitcoin is no longer the only cryptocurrency in the market. Numerous altcoins are vying for market share, and some offer innovative features that could attract investors away from Bitcoin.

- Security Risks: Bitcoin exchanges and wallets are vulnerable to hacking and theft. High-profile security breaches could erode investor confidence and negatively impact its price.

- Environmental Concerns: Bitcoin mining consumes a significant amount of energy, raising environmental concerns. If Bitcoin mining becomes more heavily regulated or if more environmentally friendly alternatives emerge, it could impact its value.

- Market Volatility: Bitcoin is known for its extreme price volatility. Sudden price swings can scare away investors and create uncertainty in the market.

Key Metrics to Watch

To gain a better understanding of Bitcoin’s potential price trajectory, it’s important to monitor key metrics:

- Active Addresses: The number of active Bitcoin addresses indicates the level of network activity and adoption.

- Transaction Volume: Transaction volume reflects the amount of Bitcoin being used for transactions.

- Hash Rate: The hash rate measures the computational power used to mine Bitcoin, indicating the security and health of the network.

- Mining Difficulty: Mining difficulty adjusts to maintain a consistent block creation rate.

- Google Trends: Search interest in Bitcoin can provide insights into public awareness and sentiment.

Conclusion: A Cautiously Optimistic Outlook

Predicting Bitcoin’s price in 2025 is inherently uncertain, but based on current trends and expert opinions, a cautiously optimistic outlook seems reasonable. Factors such as increasing institutional adoption, growing awareness, and Bitcoin’s potential as a hedge against inflation suggest that its price could continue to rise. However, investors should be aware of the potential challenges and risks, including regulatory uncertainty, competition from other cryptocurrencies, and security concerns.

Ultimately, the future of Bitcoin’s price will depend on a complex interplay of factors. By staying informed, monitoring key metrics, and understanding the risks and opportunities, investors can make more informed decisions about their Bitcoin investments.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in cryptocurrencies involves significant risks, and you could lose your entire investment. Always do your own research and consult with a qualified financial advisor before making any investment decisions.