- What Are Meme Coins And Why Are They So Popular?

- What Are Meme Coins And Why Are They So Popular?

- Bitcoin Adoption In 2025: A Tipping Point Or Continued Gradual Growth?

- How To Buy Bitcoin: A Comprehensive Guide For Beginners And Beyond

- Bitcoin Halving 2025: A Deep Dive Into Potential Impacts And Future Prospects

Bitcoin, the world’s first and most dominant cryptocurrency, continues to captivate investors, technologists, and economists alike. As we approach 2024, the question on everyone’s mind is: Where is Bitcoin headed? This article delves into a comprehensive Bitcoin price prediction for 2024, examining the factors that could influence its trajectory, expert opinions, and potential scenarios.

Understanding the Foundations: Bitcoin’s Key Drivers

Before diving into specific price predictions, it’s crucial to understand the underlying forces that drive Bitcoin’s value:

- Supply and Demand: Bitcoin’s scarcity is a fundamental principle. With a hard cap of 21 million coins, its limited supply contrasts sharply with potentially increasing demand, which could drive prices up.

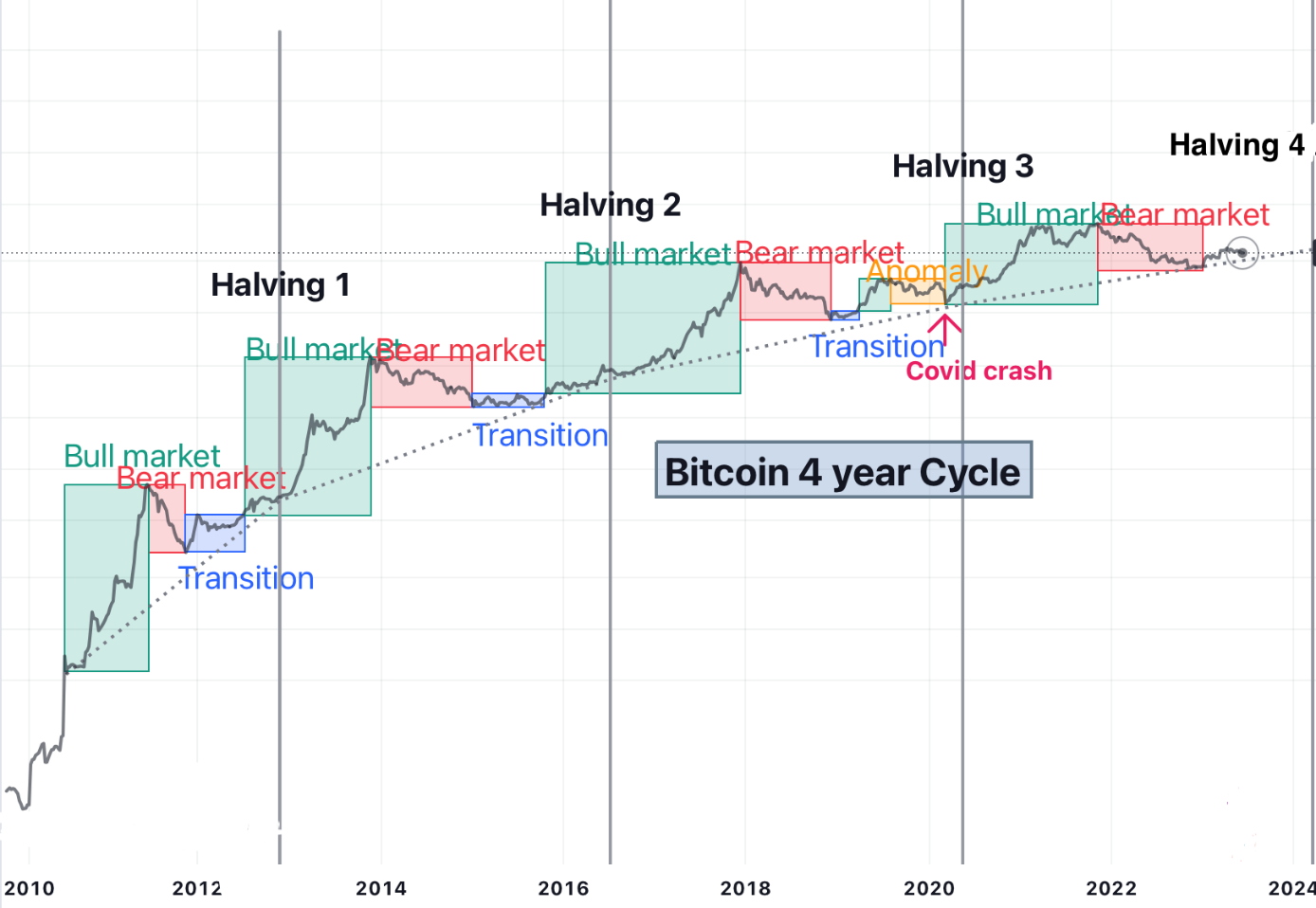

- Halving Events: Approximately every four years, Bitcoin undergoes a "halving," where the reward for mining new blocks is cut in half. This reduces the rate at which new Bitcoins enter circulation, historically leading to price appreciation. The next halving is expected in the first half of 2024.

- Adoption and Institutional Interest: Increased adoption by individuals, businesses, and institutions (like hedge funds and corporations) can significantly boost Bitcoin’s price. Institutional investment, in particular, brings substantial capital and legitimacy to the market.

- Regulatory Landscape: Government regulations can have a profound impact on Bitcoin. Positive regulations that provide clarity and legitimacy can foster growth, while restrictive regulations can stifle adoption and drive down prices.

- Macroeconomic Factors: Broader economic conditions, such as inflation, interest rates, and geopolitical events, can influence Bitcoin’s price. Bitcoin is sometimes viewed as a hedge against inflation or a safe-haven asset during times of uncertainty.

- Technological Developments: Advancements in Bitcoin’s technology, such as the Lightning Network (a layer-2 scaling solution), can improve its usability and attract more users, potentially increasing its value.

- Market Sentiment: News, social media trends, and overall investor sentiment can create short-term price volatility. Fear of missing out (FOMO) and panic selling can lead to rapid price swings.

Expert Opinions and Predictions

It’s essential to note that predicting the future of Bitcoin is inherently speculative. However, analyzing expert opinions and models can provide valuable insights. Here’s a summary of various perspectives:

-

Bullish Outlook: Some analysts believe that Bitcoin could reach new all-time highs in 2024, potentially exceeding $100,000 or even $150,000. Their reasoning often includes:

- The upcoming halving event reducing the supply of new Bitcoins.

- Increased institutional adoption, with more companies adding Bitcoin to their balance sheets.

- Growing acceptance of Bitcoin as a store of value and a hedge against inflation.

- The potential for Bitcoin to become a mainstream payment method.

-

Moderate Outlook: Other experts take a more cautious approach, predicting a gradual increase in Bitcoin’s price, potentially reaching $50,000 to $80,000 by the end of 2024. Their rationale includes:

- The possibility of regulatory headwinds slowing down adoption.

- The presence of alternative cryptocurrencies (altcoins) that may compete with Bitcoin.

- The potential for market corrections and periods of consolidation.

- The uncertainty surrounding macroeconomic conditions.

-

Bearish Outlook: A smaller number of analysts foresee a potential decline in Bitcoin’s price, possibly falling below $20,000. Their concerns include:

- A potential bursting of the cryptocurrency bubble.

- Increased government scrutiny and crackdowns on cryptocurrencies.

- The emergence of a superior cryptocurrency that could displace Bitcoin.

- A major security breach or technological flaw in the Bitcoin network.

Factors to Watch in 2024

To make informed decisions about Bitcoin, it’s crucial to monitor the following factors closely:

- Halving Event: The timing and impact of the next Bitcoin halving will be a key factor in determining its price.

- Regulatory Developments: Keep an eye on regulations in major economies, such as the United States, Europe, and Asia.

- Institutional Investment: Track the level of institutional investment in Bitcoin and other cryptocurrencies.

- Macroeconomic Trends: Monitor inflation rates, interest rates, and other economic indicators.

- Technological Advancements: Stay informed about developments in Bitcoin’s technology, such as the Lightning Network and sidechains.

- Geopolitical Events: Be aware of geopolitical events that could impact Bitcoin’s price, such as wars, political instability, and economic crises.

- Adoption Metrics: Monitor the number of Bitcoin users, transactions, and businesses accepting Bitcoin.

- Competitor Analysis: Track the performance and developments of other cryptocurrencies.

Potential Scenarios for Bitcoin in 2024

Based on the above factors, here are a few potential scenarios for Bitcoin in 2024:

- Bull Case: The halving event triggers a significant supply shock, while institutional adoption continues to grow. Positive regulations provide clarity and legitimacy to the market. Bitcoin becomes increasingly accepted as a store of value and a hedge against inflation. In this scenario, Bitcoin could reach $100,000 or higher.

- Base Case: The halving event has a moderate impact on Bitcoin’s price. Institutional adoption continues at a steady pace. Regulations are mixed, with some positive developments and some setbacks. Bitcoin remains a popular cryptocurrency, but faces competition from altcoins. In this scenario, Bitcoin could reach $50,000 to $80,000.

- Bear Case: The halving event fails to trigger a significant price increase. Regulations become more restrictive, stifling adoption. A major security breach or technological flaw undermines confidence in Bitcoin. A superior cryptocurrency emerges and displaces Bitcoin. In this scenario, Bitcoin could fall below $20,000.

The Impact of the Halving on Price

The Bitcoin halving is an event that occurs approximately every four years. It involves reducing the block reward given to miners for verifying transactions by half. This event is designed to control the supply of new Bitcoins entering the market, ultimately leading to a capped supply of 21 million coins.

Historically, Bitcoin halvings have been followed by significant price increases. The reasoning behind this is that a reduction in supply, coupled with consistent or increasing demand, tends to drive the price up. The halvings in 2012 and 2016 were followed by substantial bull runs in the subsequent years.

However, it’s important to note that past performance is not always indicative of future results. As Bitcoin matures and the market becomes more efficient, the impact of halvings may diminish. Other factors, such as regulatory developments, institutional adoption, and macroeconomic conditions, can also play a significant role in determining Bitcoin’s price.

The Role of Regulation in Shaping Bitcoin’s Future

Regulation is a critical factor that can either boost or hinder Bitcoin’s growth. Clear and favorable regulations can provide legitimacy, attract institutional investors, and foster innovation. On the other hand, restrictive or unclear regulations can create uncertainty, drive away investors, and stifle adoption.

Several countries are currently working on developing regulatory frameworks for cryptocurrencies. Some are taking a more progressive approach, while others are adopting a more cautious stance. The outcome of these regulatory efforts will have a significant impact on Bitcoin’s future.

The Rise of Institutional Adoption

Institutional adoption refers to the increasing involvement of institutions, such as hedge funds, corporations, and pension funds, in the Bitcoin market. This trend has been gaining momentum in recent years, as more institutions recognize Bitcoin’s potential as a store of value and an investment asset.

Institutional investment can bring substantial capital and legitimacy to the market, potentially driving up Bitcoin’s price. However, it can also increase volatility, as institutions may have different investment strategies and risk tolerances than retail investors.

Bitcoin’s Use Cases and Adoption

Bitcoin’s primary use cases include:

- Store of Value: Bitcoin is often seen as a digital alternative to gold, providing a hedge against inflation and economic uncertainty.

- Medium of Exchange: While not yet widely used for everyday transactions, Bitcoin is increasingly accepted by businesses and online merchants.

- Remittances: Bitcoin can be used to send money across borders quickly and cheaply, bypassing traditional banking systems.

- Decentralized Finance (DeFi): Bitcoin is used as collateral in DeFi applications, allowing users to earn interest and access financial services without intermediaries.

The level of adoption of these use cases will play a significant role in determining Bitcoin’s price in 2024.

Conclusion

Predicting Bitcoin’s price in 2024 is a challenging task, given the complex interplay of factors that can influence its trajectory. While expert opinions and models can provide valuable insights, it’s crucial to approach them with caution and conduct your own research.

By closely monitoring the halving event, regulatory developments, institutional investment, macroeconomic trends, and technological advancements, you can make more informed decisions about Bitcoin. Remember that the cryptocurrency market is inherently volatile, and it’s essential to manage your risk accordingly.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in Bitcoin and other cryptocurrencies carries significant risks, and you should only invest what you can afford to lose. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.