- Are Meme Coins A Good Investment Or Just A Gamble?

- Bitcoin Trading Strategies: A Comprehensive Guide

- Bitcoin Mining Profitability: A Comprehensive Guide

- Bitcoin Mining Profitability: Navigating The Landscape In [Year]

- Bitcoin Investment Strategies: Navigating The World Of Digital Gold

Bitcoin, the pioneering cryptocurrency, operates on a decentralized, transparent, and immutable blockchain network. Its scarcity is hardcoded into its design, with a finite supply of 21 million coins. One of the core mechanisms that reinforce this scarcity is the "halving" event, a pre-programmed reduction in the reward miners receive for validating new blocks. These events, occurring roughly every four years, have historically had a significant impact on Bitcoin’s price, mining dynamics, and overall market sentiment. As we approach the anticipated 2025 halving, it is crucial to understand its implications and potential impact on the cryptocurrency landscape.

Understanding Bitcoin Halving

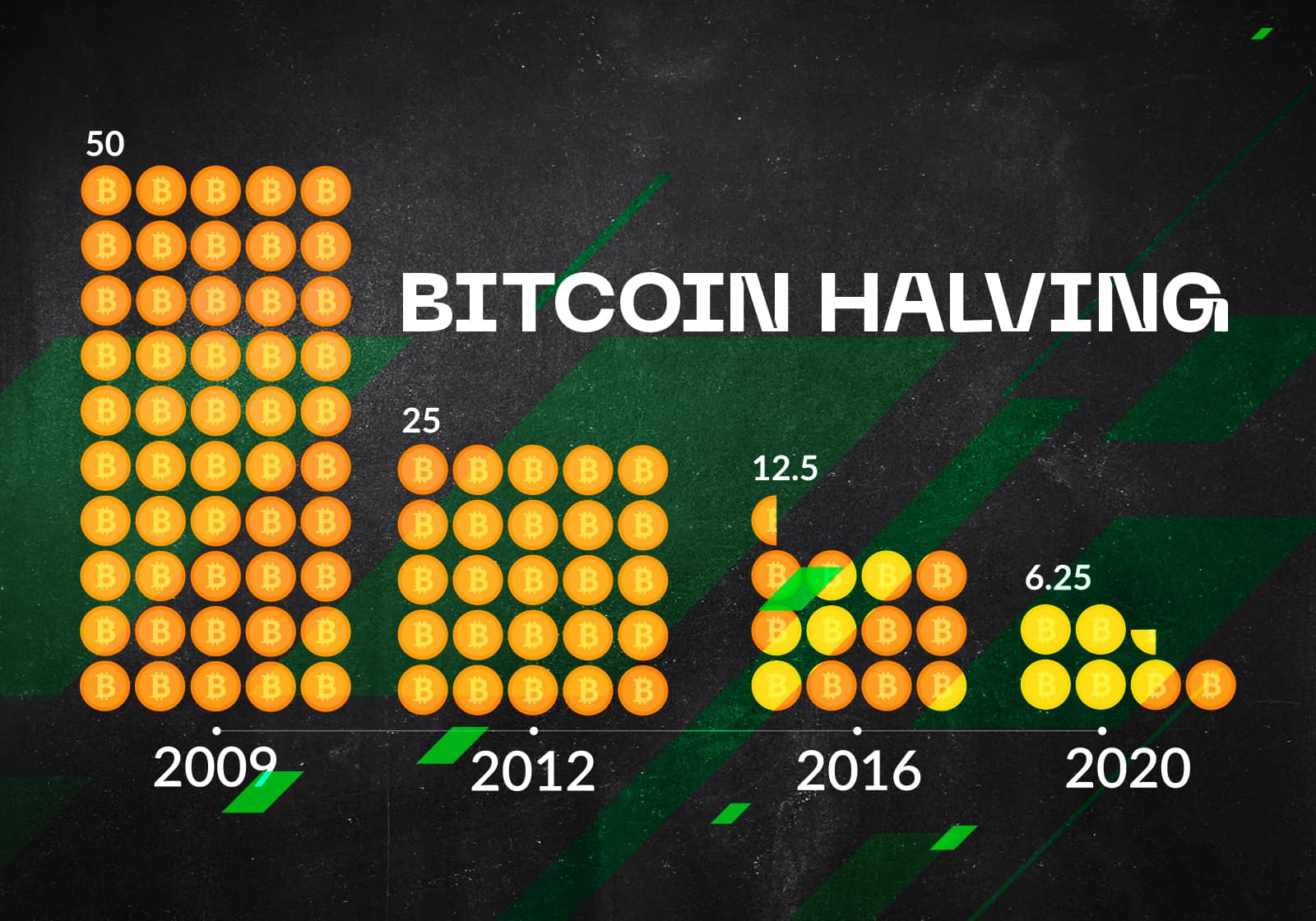

The Bitcoin protocol was designed by its pseudonymous creator, Satoshi Nakamoto, with a deflationary model at its core. To achieve this, the block reward, the incentive given to miners for adding new blocks to the blockchain, is halved at predetermined intervals. Initially, miners received 50 BTC per block. This was halved to 25 BTC in 2012, then to 12.5 BTC in 2016, and most recently to 6.25 BTC in May 2020. The next halving, expected in the first half of 2025, will reduce the block reward to 3.125 BTC.

This reduction in the reward has several key effects:

- Reduced Supply: Halving directly reduces the rate at which new bitcoins enter circulation. This diminished supply, assuming demand remains constant or increases, can lead to price appreciation.

- Increased Scarcity: The halving reinforces Bitcoin’s scarcity, a key feature that distinguishes it from traditional fiat currencies which can be printed at will.

- Impact on Miners: Halving significantly impacts the profitability of Bitcoin mining. Miners must adapt by increasing efficiency, reducing costs, or relying on transaction fees to compensate for the reduced block reward.

- Market Sentiment: Halving events often generate significant media attention and investor interest, leading to increased trading volume and potential price volatility.

Historical Impact of Bitcoin Halving Events

Analyzing the historical impact of previous halving events provides valuable insights into the potential effects of the upcoming 2025 halving.

- 2012 Halving: The first halving occurred in November 2012, reducing the block reward from 50 BTC to 25 BTC. In the year following the halving, Bitcoin’s price rose dramatically, from around $12 to over $1,000. While other factors were at play, the reduced supply and increased scarcity contributed to this significant price surge.

- 2016 Halving: The second halving took place in July 2016, lowering the block reward to 12.5 BTC. Similar to the first halving, Bitcoin’s price experienced substantial growth in the following year, climbing from around $650 to nearly $20,000 by the end of 2017. This surge was fueled by increased institutional interest and mainstream adoption.

- 2020 Halving: The third halving occurred in May 2020, reducing the block reward to 6.25 BTC. Despite initial market uncertainty due to the COVID-19 pandemic, Bitcoin’s price surged in the months following the halving, reaching new all-time highs above $69,000 in late 2021. This rally was driven by institutional adoption, corporate investments, and increased retail participation.

While past performance is not indicative of future results, the historical data suggests that Bitcoin halvings have consistently been followed by periods of significant price appreciation.

Potential Impacts of the 2025 Halving

The 2025 halving is expected to have a multifaceted impact on the Bitcoin ecosystem.

- Price Appreciation: The most anticipated effect is a potential price increase. The reduced supply of new bitcoins, coupled with sustained or increasing demand, could drive prices higher. However, the magnitude and timing of any price appreciation remain uncertain and depend on various market factors.

- Mining Industry Consolidation: Halving events can put pressure on less efficient miners. Miners with high operating costs or outdated equipment may struggle to remain profitable with the reduced block reward. This could lead to consolidation within the mining industry, with larger, more efficient mining operations gaining a greater market share.

- Increased Transaction Fees: As the block reward decreases, miners may become more reliant on transaction fees to compensate for the reduced income. This could lead to higher transaction fees for users, particularly during periods of high network congestion.

- Renewed Scarcity Narrative: The halving reinforces Bitcoin’s scarcity narrative, which is a key driver of its value proposition. As the supply of new bitcoins diminishes, investors may view Bitcoin as a hedge against inflation and currency debasement.

- Market Volatility: Halving events often generate increased market volatility as traders and investors speculate on the potential price impact. This volatility can create both opportunities and risks for traders.

- Technological Advancements: The halving may incentivize miners to adopt more efficient mining technologies and explore alternative energy sources to reduce operating costs. This could lead to further innovation and sustainability within the Bitcoin mining industry.

Factors Influencing the Impact of the 2025 Halving

The actual impact of the 2025 halving will depend on several factors:

- Market Sentiment: Overall market sentiment towards Bitcoin and cryptocurrencies will play a crucial role. Positive sentiment, driven by factors such as regulatory clarity, institutional adoption, and mainstream awareness, could amplify the price impact of the halving.

- Demand for Bitcoin: The level of demand for Bitcoin from retail and institutional investors will be a key determinant of its price. Increased adoption and usage of Bitcoin for payments, investments, and other applications could drive demand higher.

- Macroeconomic Conditions: Broader macroeconomic conditions, such as inflation, interest rates, and economic growth, can influence investor sentiment and capital flows into or out of Bitcoin.

- Regulatory Environment: The regulatory landscape surrounding Bitcoin and cryptocurrencies continues to evolve. Clear and supportive regulations could boost investor confidence and attract more institutional capital. Conversely, restrictive regulations could dampen demand and limit price appreciation.

- Technological Developments: Technological advancements, such as the development of layer-2 scaling solutions like the Lightning Network, could improve Bitcoin’s scalability and usability, making it more attractive to a wider audience.

- Mining Industry Dynamics: The efficiency, cost structure, and geographical distribution of Bitcoin miners will influence the overall security and stability of the network.

Challenges and Risks

While the halving is generally viewed as a positive event for Bitcoin, it also presents certain challenges and risks:

- Miner Profitability: The reduced block reward can put pressure on miners, particularly those with high operating costs. This could lead to a decrease in the hash rate, which is the computational power used to secure the Bitcoin network. A significant decline in hash rate could make the network more vulnerable to attacks.

- Centralization of Mining: As less efficient miners are forced to exit the market, mining could become more centralized in the hands of a few large mining operations. This could raise concerns about the decentralization and security of the Bitcoin network.

- Transaction Fee Volatility: Increased reliance on transaction fees could lead to volatility in transaction costs, making it more expensive to use Bitcoin for everyday transactions.

- Market Manipulation: The halving event can create opportunities for market manipulation, as traders attempt to profit from the anticipated price volatility.

Strategies for Navigating the 2025 Halving

For investors and traders, the 2025 halving presents both opportunities and risks. Here are some strategies for navigating this event:

- Do Your Own Research (DYOR): Stay informed about the latest developments in the Bitcoin market and understand the potential impacts of the halving.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different asset classes to mitigate risk.

- Manage Risk: Use risk management tools such as stop-loss orders to limit potential losses.

- Consider Long-Term Investing: Bitcoin is a volatile asset, but it has the potential for long-term growth. Consider adopting a long-term investment strategy to ride out short-term price fluctuations.

- Stay Informed About Regulatory Developments: Keep abreast of regulatory changes that could impact the Bitcoin market.

- Evaluate Mining Investments Carefully: If you are considering investing in Bitcoin mining, carefully evaluate the profitability and risks associated with different mining operations.

Conclusion

The Bitcoin halving 2025 is a highly anticipated event that could have significant implications for the cryptocurrency market. While the historical data suggests that halvings have been followed by periods of price appreciation, the actual impact will depend on a variety of factors, including market sentiment, demand, macroeconomic conditions, and regulatory developments. Investors and traders should approach the halving with caution, conduct thorough research, and manage their risk accordingly. By understanding the potential impacts and challenges associated with the halving, participants can make informed decisions and navigate the evolving Bitcoin landscape. The halving reaffirms Bitcoin’s core principle of scarcity and its potential as a store of value in an increasingly digital world. As Bitcoin continues to mature and gain wider acceptance, the halving events will remain a crucial mechanism for maintaining its decentralized and deflationary properties.