- How Does Bitcoin Work? A Deep Dive Into The Cryptocurrency Revolution

- Bitcoin Trading Strategies: A Comprehensive Guide

- Bitcoin Price Prediction 2024: Analyzing Trends, Experts, And Future Potential

- Bitcoin And Inflation: A Hedge, A Haven, Or Just Hype?

- Bitcoin: Navigating The Future Landscape – Trends, Challenges, And Opportunities

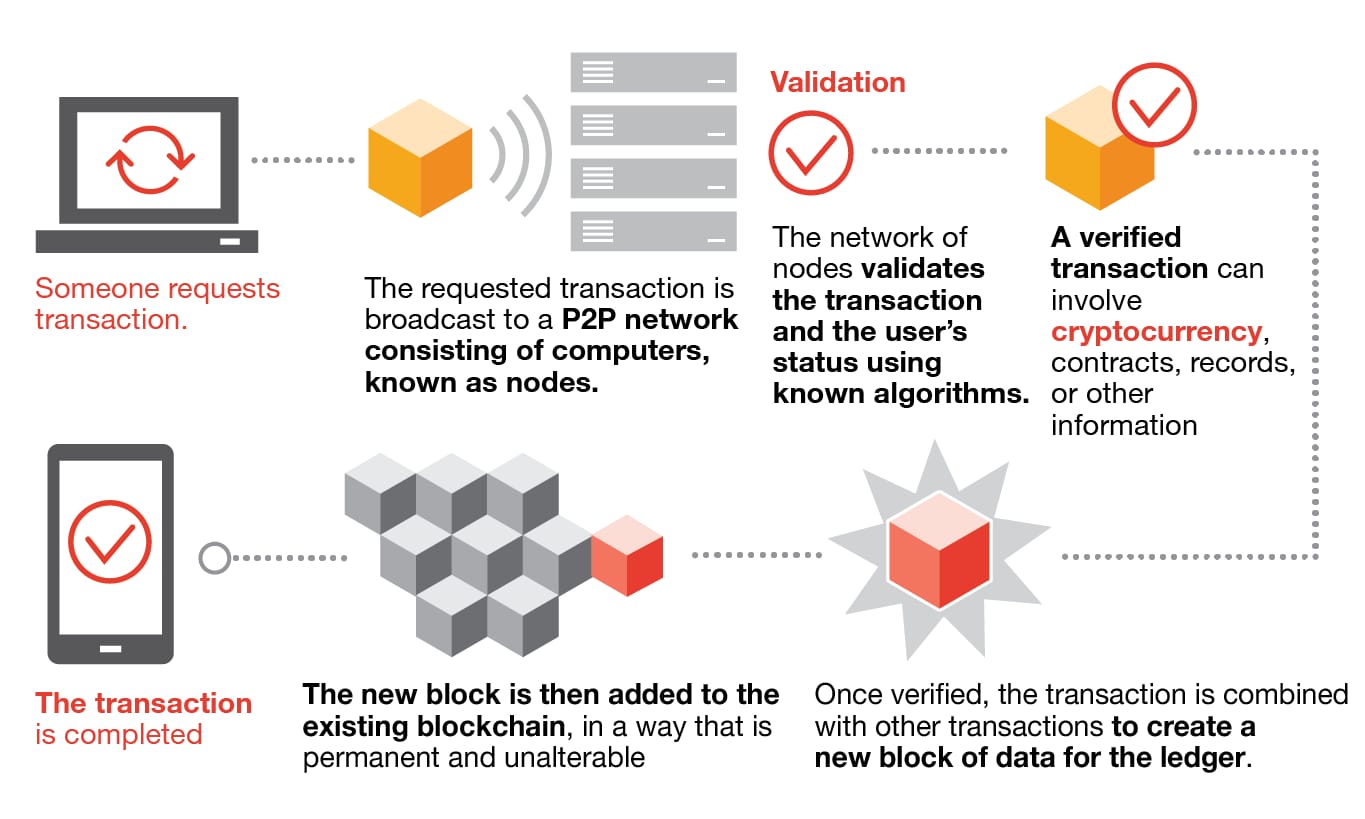

Bitcoin, the pioneering cryptocurrency, owes its existence and functionality to a groundbreaking technology called the blockchain. This decentralized, distributed, and immutable ledger serves as the foundation for all Bitcoin transactions, ensuring transparency, security, and trust without the need for a central authority. Understanding the intricacies of Bitcoin’s blockchain is crucial for comprehending the cryptocurrency’s potential and its broader implications for various industries.

1. What is a Blockchain?

At its core, a blockchain is a chain of blocks, where each block contains a set of transactions and is cryptographically linked to the previous block. This creates a chronological and tamper-proof record of all transactions that have ever occurred on the network.

Key characteristics of a blockchain:

- Decentralization: The blockchain is not stored in a single location but is distributed across a network of computers (nodes).

- Transparency: All transactions recorded on the blockchain are publicly viewable and verifiable.

- Immutability: Once a block is added to the blockchain, it cannot be altered or deleted.

- Security: Cryptographic techniques, such as hashing and digital signatures, are used to secure the blockchain and prevent unauthorized access or modification.

- Consensus: A consensus mechanism ensures that all nodes in the network agree on the validity of new transactions and blocks.

2. Bitcoin’s Blockchain: A Specific Implementation

Bitcoin’s blockchain is a specific implementation of blockchain technology, tailored to the needs of the Bitcoin cryptocurrency. It is a public, permissionless blockchain, meaning that anyone can participate in the network, view the transaction history, and contribute to the validation of new blocks.

3. Blocks: The Building Blocks

A block is a container that holds a collection of Bitcoin transactions, along with metadata about the block itself. Each block in the Bitcoin blockchain consists of the following components:

- Block Header: Contains metadata about the block, including:

- Version: Indicates the block structure and validation rules.

- Previous Block Hash: A cryptographic hash of the previous block’s header, linking the current block to the chain.

- Merkle Root: A hash of all the transactions in the block, providing a concise summary of the block’s contents.

- Timestamp: The time the block was created.

- Difficulty Target: A value that determines the difficulty of mining the block.

- Nonce: A random number that miners adjust to find a hash that meets the difficulty target.

- Transaction Counter: Indicates the number of transactions in the block.

- Transactions: A list of all the transactions included in the block.

4. Transactions: The Lifeblood of the Blockchain

A Bitcoin transaction is a transfer of Bitcoin from one address to another. Each transaction consists of the following components:

- Inputs: References to previous transactions from which the Bitcoin is being spent.

- Outputs: Specifies the recipient addresses and the amount of Bitcoin being transferred to each address.

- Locktime: A field that specifies the earliest time or block height at which the transaction can be added to the blockchain.

- Signature: A digital signature that proves the sender’s ownership of the Bitcoin being spent.

5. Mining: Securing the Blockchain and Creating New Bitcoins

Mining is the process of validating new transactions, grouping them into blocks, and adding those blocks to the blockchain. Miners compete to solve a complex mathematical problem, and the first miner to find a solution gets to add the next block to the chain and receive a reward in the form of newly created Bitcoins and transaction fees.

The mining process involves the following steps:

- Transaction Selection: Miners select a set of valid transactions from the mempool (a pool of unconfirmed transactions).

- Block Creation: Miners create a new block containing the selected transactions, along with the block header.

- Hashing: Miners repeatedly hash the block header, changing the nonce value each time, until they find a hash that is below the difficulty target.

- Block Propagation: Once a miner finds a valid hash, they broadcast the new block to the network.

- Block Validation: Other nodes in the network validate the new block and add it to their copy of the blockchain.

The difficulty target is adjusted periodically to ensure that blocks are added to the blockchain at a consistent rate of approximately one block every 10 minutes. This adjustment is based on the total computing power of the network.

6. Consensus Mechanisms: Ensuring Agreement

A consensus mechanism is a set of rules that ensures that all nodes in the network agree on the validity of new transactions and blocks. Bitcoin uses a consensus mechanism called Proof-of-Work (PoW).

Proof-of-Work (PoW):

In PoW, miners must expend computational effort to solve a complex mathematical problem in order to add a new block to the blockchain. This makes it computationally expensive to tamper with the blockchain, as an attacker would need to control a majority of the network’s computing power to successfully rewrite the chain.

7. The Importance of Cryptography

Cryptography plays a crucial role in securing the Bitcoin blockchain and ensuring the integrity of transactions. Some of the key cryptographic techniques used in Bitcoin include:

- Hashing: A one-way function that takes an input and produces a fixed-size output (hash). Hashing is used to create the Merkle root in each block and to link blocks together in the chain.

- Digital Signatures: Used to verify the authenticity of transactions and prove ownership of Bitcoin.

- Elliptic Curve Cryptography (ECC): Used to generate the public and private key pairs that are used for Bitcoin addresses and digital signatures.

8. Advantages of Bitcoin’s Blockchain

- Decentralization: Eliminates the need for a central authority, reducing the risk of censorship and single points of failure.

- Transparency: All transactions are publicly viewable, promoting accountability and trust.

- Immutability: Once a block is added to the blockchain, it cannot be altered or deleted, ensuring the integrity of the transaction history.

- Security: Cryptographic techniques and the PoW consensus mechanism make it extremely difficult to tamper with the blockchain.

- Global and Permissionless: Anyone can participate in the Bitcoin network and send or receive Bitcoin transactions.

9. Disadvantages and Challenges

- Scalability: Bitcoin’s blockchain has limited transaction throughput, which can lead to slow transaction times and high fees during periods of high demand.

- Energy Consumption: The PoW consensus mechanism requires significant amounts of energy, raising environmental concerns.

- Complexity: Understanding the technical details of Bitcoin’s blockchain can be challenging for non-technical users.

- Volatility: The price of Bitcoin can be highly volatile, making it a risky investment.

10. Potential Applications Beyond Cryptocurrency

While Bitcoin’s blockchain was initially designed for cryptocurrency, the underlying technology has the potential to be applied to a wide range of other industries, including:

- Supply Chain Management: Tracking goods and materials as they move through the supply chain.

- Healthcare: Securely storing and sharing medical records.

- Voting Systems: Creating transparent and secure voting systems.

- Digital Identity: Managing and verifying digital identities.

- Intellectual Property Protection: Registering and tracking ownership of intellectual property.

11. Conclusion

Bitcoin’s blockchain technology represents a paradigm shift in the way we think about trust, security, and data management. While it has its limitations and challenges, its potential to revolutionize various industries is undeniable. As the technology continues to evolve, we can expect to see even more innovative applications of blockchain technology in the years to come. Understanding the core principles of Bitcoin’s blockchain is essential for anyone seeking to navigate the rapidly changing landscape of digital technology and its impact on our world.