- Bitcoin Price Prediction 2025: Decoding The Future Of The Crypto King

- Bitcoin Halving 2025: A Deep Dive Into Potential Impacts And Future Prospects

- What Are Meme Coins And Why Are They So Popular?

- How Meme Coins Are Shaping The Future Of Digital Currency

- Bitcoin Investment Strategies: Navigating The World Of Digital Gold

In the ever-evolving landscape of finance, investors are constantly seeking opportunities to grow their wealth and secure their financial future. For decades, traditional investments like stocks, bonds, and real estate have been the cornerstones of investment portfolios. However, the emergence of Bitcoin and other cryptocurrencies has introduced a new paradigm, challenging the established norms and sparking a debate about the merits of digital assets versus traditional investments.

This article aims to provide a comprehensive comparison between Bitcoin and traditional investments, examining their characteristics, risks, rewards, and suitability for different investment goals. By delving into the intricacies of each asset class, investors can make informed decisions and construct well-diversified portfolios that align with their individual circumstances.

Understanding Traditional Investments

Traditional investments encompass a wide range of assets that have been around for centuries, serving as reliable vehicles for wealth accumulation. These investments are typically regulated by government agencies and financial institutions, providing a degree of security and transparency. Some of the most common types of traditional investments include:

- Stocks: Represent ownership in a publicly traded company, offering the potential for capital appreciation and dividend income.

- Bonds: Represent debt issued by governments or corporations, providing a fixed income stream and serving as a relatively safe investment option.

- Real Estate: Involves the purchase of land or property, offering the potential for rental income and capital appreciation.

- Mutual Funds: Pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets, providing professional management and diversification benefits.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, but traded on stock exchanges like individual stocks, offering greater flexibility and lower expense ratios.

The Allure of Bitcoin

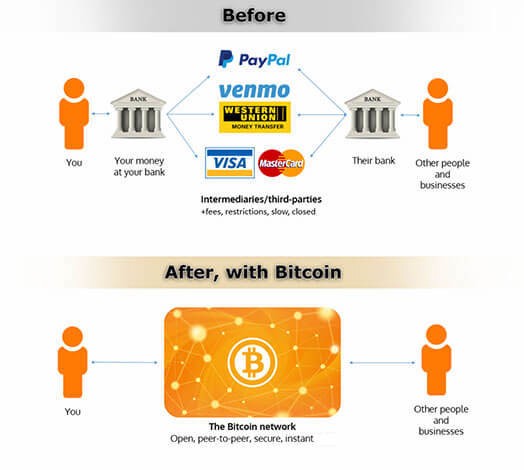

Bitcoin, the first and most well-known cryptocurrency, was created in 2009 as a decentralized digital currency, operating independently of central banks and financial institutions. Its underlying technology, blockchain, provides a secure and transparent ledger for recording transactions. Bitcoin has gained significant popularity as an alternative investment asset due to its:

- Decentralization: Bitcoin is not controlled by any single entity, making it resistant to censorship and manipulation.

- Limited Supply: The total number of Bitcoins that can ever be created is capped at 21 million, potentially driving up its value as demand increases.

- Global Accessibility: Bitcoin can be easily transferred across borders without the need for intermediaries, making it a convenient option for international transactions.

- Potential for High Returns: Bitcoin has historically exhibited high volatility, offering the potential for significant gains, but also carrying substantial risks.

Comparing Bitcoin and Traditional Investments: Key Factors

To effectively compare Bitcoin and traditional investments, it’s crucial to consider several key factors:

-

Risk and Volatility:

- Bitcoin: Known for its extreme volatility, with prices experiencing dramatic swings in short periods. This makes it a high-risk investment, unsuitable for risk-averse investors.

- Traditional Investments: Generally less volatile than Bitcoin, with stocks considered riskier than bonds. Real estate can also be subject to market fluctuations.

-

Returns:

- Bitcoin: Has the potential for high returns, but also carries the risk of significant losses. Past performance is not indicative of future results.

- Traditional Investments: Offer more stable and predictable returns, but typically lower than Bitcoin’s potential gains.

-

Regulation:

- Bitcoin: Operates in a largely unregulated environment, which can be both an advantage and a disadvantage. Lack of regulation can lead to scams and fraud, but also allows for greater innovation.

- Traditional Investments: Subject to strict regulations by government agencies and financial institutions, providing investor protection and ensuring market integrity.

-

Liquidity:

- Bitcoin: Highly liquid, with exchanges available 24/7 for buying and selling. However, liquidity can vary depending on the exchange and trading volume.

- Traditional Investments: Generally liquid, but some assets like real estate may take time to sell.

-

Diversification:

- Bitcoin: Can be used to diversify a portfolio, as its price movements are not always correlated with traditional assets.

- Traditional Investments: Offer diversification within their respective asset classes, such as investing in a mix of stocks and bonds.

-

Accessibility:

- Bitcoin: Accessible to anyone with an internet connection and a digital wallet.

- Traditional Investments: May require a brokerage account or financial advisor.

-

Storage and Security:

- Bitcoin: Requires secure storage in a digital wallet, with the responsibility falling on the individual investor.

- Traditional Investments: Typically held by financial institutions, providing a level of security and protection.

-

Inflation Hedge:

- Bitcoin: Often touted as an inflation hedge due to its limited supply, but its effectiveness in this regard is still debated.

- Traditional Investments: Some assets, like real estate and commodities, can act as inflation hedges.

Pros and Cons of Bitcoin

Pros:

- Potential for high returns

- Decentralization and censorship resistance

- Limited supply

- Global accessibility

- Diversification benefits

Cons:

- High volatility and risk

- Lack of regulation

- Security concerns

- Complex technology

- Uncertain future

Pros and Cons of Traditional Investments

Pros:

- Lower volatility and risk

- Regulation and investor protection

- Stable and predictable returns

- Liquidity

- Diversification within asset classes

Cons:

- Lower potential returns

- Susceptible to inflation

- Fees and expenses

- May require a brokerage account or financial advisor

- Can be affected by economic downturns

Who Should Invest in Bitcoin?

Bitcoin may be suitable for:

- Investors with a high-risk tolerance

- Those seeking diversification

- Individuals who understand the technology and risks involved

- Investors with a long-term investment horizon

Who Should Invest in Traditional Investments?

Traditional investments may be suitable for:

- Risk-averse investors

- Those seeking stable and predictable returns

- Individuals with a shorter investment horizon

- Investors who prefer regulated and established markets

Conclusion

Bitcoin and traditional investments each have their own unique characteristics, risks, and rewards. Bitcoin offers the potential for high returns but comes with significant volatility and risk, while traditional investments provide more stability and regulation but may offer lower returns.

Ultimately, the decision of whether to invest in Bitcoin or traditional investments depends on individual circumstances, risk tolerance, investment goals, and knowledge of the assets involved. A well-diversified portfolio that includes a mix of both traditional and alternative investments may be the most prudent approach for many investors.

It is essential to conduct thorough research, seek professional advice, and carefully consider your own financial situation before making any investment decisions. The world of finance is constantly evolving, and staying informed is crucial for navigating the complexities and achieving your financial goals.