- The Rise Of Meme Coins: A New Era Of Crypto Hype

- Are Meme Coins A Good Investment Or Just A Gamble?

- What Are Meme Coins And Why Are They So Popular?

- Bitcoin ATMs Near Me: A Comprehensive Guide To Buying And Selling Cryptocurrency Locally

- What Is Bitcoin? A Comprehensive Guide To The World’s First Cryptocurrency

Bitcoin and Blockchain Explained: A Comprehensive Guide

Bitcoin and blockchain have become ubiquitous terms in the modern digital landscape, often mentioned in the same breath. While intrinsically linked, they represent distinct concepts with far-reaching implications. Understanding the relationship between Bitcoin and blockchain is crucial for anyone seeking to navigate the evolving world of cryptocurrencies and decentralized technologies. This article aims to demystify these concepts, providing a comprehensive explanation of Bitcoin, the underlying blockchain technology, and their potential impact.

What is Bitcoin?

At its core, Bitcoin is a decentralized digital currency, operating without the need for a central bank or single administrator. It was created in 2008 by an anonymous person or group using the pseudonym Satoshi Nakamoto, and released as open-source software in 2009. Bitcoin’s key characteristics include:

- Decentralization: No single entity controls the Bitcoin network. It operates on a peer-to-peer basis, distributed across numerous computers worldwide.

- Limited Supply: The Bitcoin protocol dictates a maximum supply of 21 million bitcoins. This scarcity is a key factor in its value proposition, differentiating it from traditional fiat currencies which can be printed by governments at will.

- Cryptography: Bitcoin relies heavily on cryptography for security. Transactions are digitally signed using private keys, ensuring that only the rightful owner can spend their bitcoins.

- Pseudonymity: Bitcoin transactions are linked to public keys (addresses) rather than personal identities. While not entirely anonymous, this provides a degree of privacy. However, blockchain analysis techniques can sometimes link addresses to real-world identities.

- Transparency: All Bitcoin transactions are recorded on a public, immutable ledger known as the blockchain, allowing anyone to view the transaction history.

How Bitcoin Works: A Simplified Overview

- Transactions: When a user wants to send Bitcoin to another user, they create a transaction. This transaction includes the sender’s address, the recipient’s address, and the amount of Bitcoin being sent.

- Digital Signature: The transaction is digitally signed using the sender’s private key, proving that they are the legitimate owner of the Bitcoin being sent.

- Broadcasting: The transaction is broadcast to the Bitcoin network, where it is picked up by nodes (computers running the Bitcoin software).

- Verification and Mining: Miners, specialized nodes in the network, collect pending transactions and group them into a block. They then compete to solve a complex mathematical problem, requiring significant computing power. This process is known as "proof-of-work."

- Block Creation: The first miner to solve the problem adds the block of transactions to the blockchain. They are rewarded with newly minted bitcoins and transaction fees.

- Blockchain Update: The new block is broadcast to the network, and all other nodes update their copy of the blockchain, ensuring a consistent and tamper-proof record of all Bitcoin transactions.

Understanding the Blockchain

The blockchain is the foundational technology underpinning Bitcoin and many other cryptocurrencies. It is essentially a distributed, immutable, and transparent ledger that records all transactions in a chronological order. Think of it like a digital record book that is shared across a vast network of computers.

- Blocks: The blockchain is composed of blocks, each containing a set of transactions.

- Chains: These blocks are linked together cryptographically, forming a chain. Each block contains a hash (a unique digital fingerprint) of the previous block.

- Immutability: Because each block contains the hash of the previous block, it is virtually impossible to alter or tamper with any block in the chain without invalidating all subsequent blocks. This immutability is a key security feature of the blockchain.

- Decentralization: The blockchain is distributed across a network of computers, meaning that no single entity controls the ledger. This decentralization makes it resistant to censorship and single points of failure.

- Transparency: All transactions recorded on the blockchain are publicly visible, although the identities of the participants are often pseudonymous.

The Relationship Between Bitcoin and Blockchain

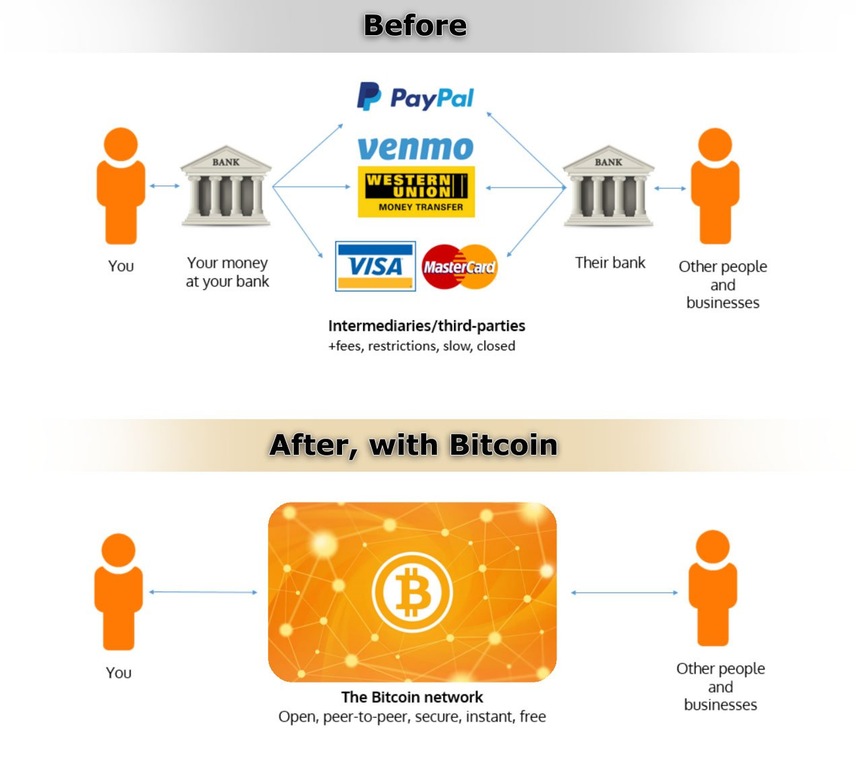

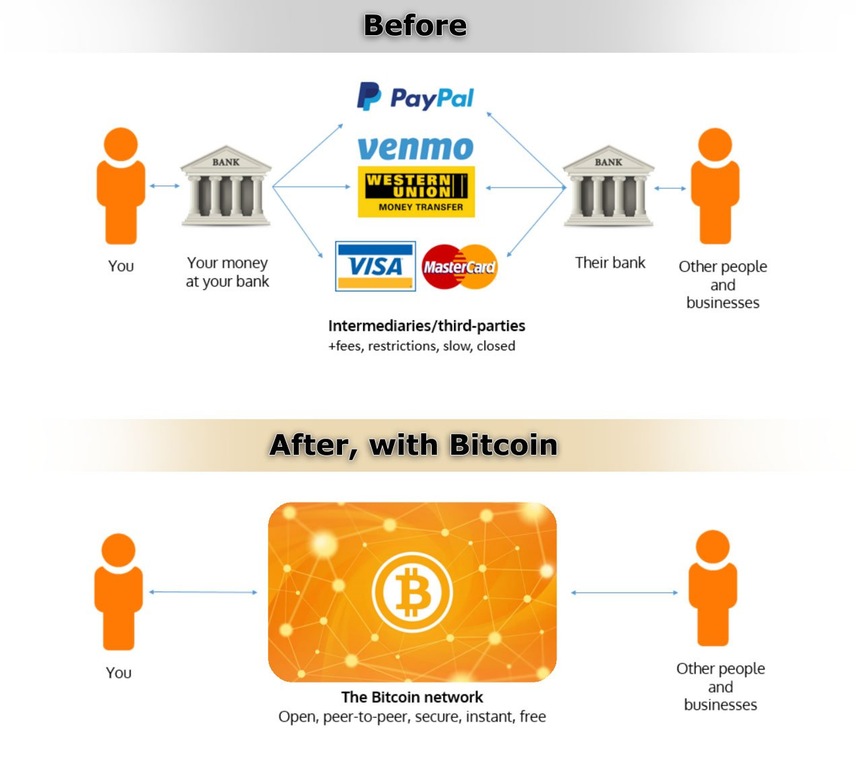

Bitcoin is an application of blockchain technology. The blockchain is the underlying infrastructure that enables Bitcoin to function as a decentralized digital currency. Without the blockchain, Bitcoin would not be possible.

- Bitcoin’s Blockchain: The Bitcoin blockchain is specifically designed to record Bitcoin transactions. It is a public, permissionless blockchain, meaning that anyone can participate in the network and view the transaction history.

- Beyond Bitcoin: While Bitcoin was the first and most well-known application of blockchain technology, the blockchain has many other potential applications beyond cryptocurrencies.

Beyond Bitcoin: Other Applications of Blockchain Technology

The potential applications of blockchain technology extend far beyond cryptocurrencies. Its decentralized, transparent, and immutable nature makes it suitable for a wide range of use cases:

- Supply Chain Management: Tracking goods and materials as they move through the supply chain, ensuring authenticity and provenance.

- Voting Systems: Creating secure and transparent voting systems that are resistant to fraud.

- Healthcare: Securely storing and sharing medical records, improving data privacy and interoperability.

- Digital Identity: Creating decentralized digital identities that are controlled by the individual, rather than a central authority.

- Real Estate: Streamlining real estate transactions, reducing fraud, and increasing transparency.

- Intellectual Property: Protecting intellectual property rights by registering and tracking ownership on the blockchain.

- Decentralized Finance (DeFi): Building decentralized financial applications, such as lending platforms, exchanges, and stablecoins.

Advantages of Bitcoin and Blockchain

- Decentralization: Reduced reliance on central authorities and intermediaries.

- Transparency: Increased visibility and accountability.

- Immutability: Enhanced security and resistance to tampering.

- Efficiency: Streamlined processes and reduced transaction costs.

- Accessibility: Increased access to financial services for underserved populations.

- Innovation: Fosters innovation and new business models.

Disadvantages and Challenges

- Volatility: Bitcoin’s price is highly volatile, making it a risky investment.

- Scalability: Bitcoin’s transaction processing capacity is limited, leading to slow transaction times and high fees during peak periods. (Solutions like the Lightning Network are being developed to address this.)

- Regulation: The regulatory landscape surrounding Bitcoin and other cryptocurrencies is still evolving, creating uncertainty for businesses and investors.

- Security Risks: While the blockchain itself is secure, exchanges and wallets can be vulnerable to hacking.

- Environmental Concerns: Bitcoin mining consumes a significant amount of energy, raising concerns about its environmental impact. (Efforts are underway to transition to more sustainable mining practices.)

- Complexity: Understanding Bitcoin and blockchain technology can be complex, creating a barrier to entry for some users.

The Future of Bitcoin and Blockchain

Bitcoin and blockchain technology are still in their early stages of development, but they have the potential to revolutionize many industries. As the technology matures and adoption increases, we can expect to see:

- Increased adoption of cryptocurrencies: More businesses and individuals will begin to use cryptocurrencies for payments and investments.

- Development of new blockchain applications: Blockchain technology will be used to solve a wider range of problems in various industries.

- Greater regulatory clarity: Governments will develop clearer regulations for cryptocurrencies and blockchain technology.

- Improved scalability and energy efficiency: Technological advancements will address the scalability and energy consumption challenges of blockchain technology.

- Integration with existing systems: Blockchain technology will be integrated with existing systems and infrastructure, making it easier to use and adopt.

Conclusion

Bitcoin and blockchain technology represent a paradigm shift in the way we think about money, data, and trust. While challenges remain, the potential benefits of decentralization, transparency, and immutability are undeniable. Understanding these concepts is essential for navigating the future of finance, technology, and the digital world. As the technology continues to evolve, it will be fascinating to see how Bitcoin and blockchain shape the future of our society. Further research and critical evaluation are crucial for anyone looking to engage with these transformative technologies.